Examples of fixed costs are your salary. Part of the cost stays consistent often a base cost and part fluctuates with business activity.

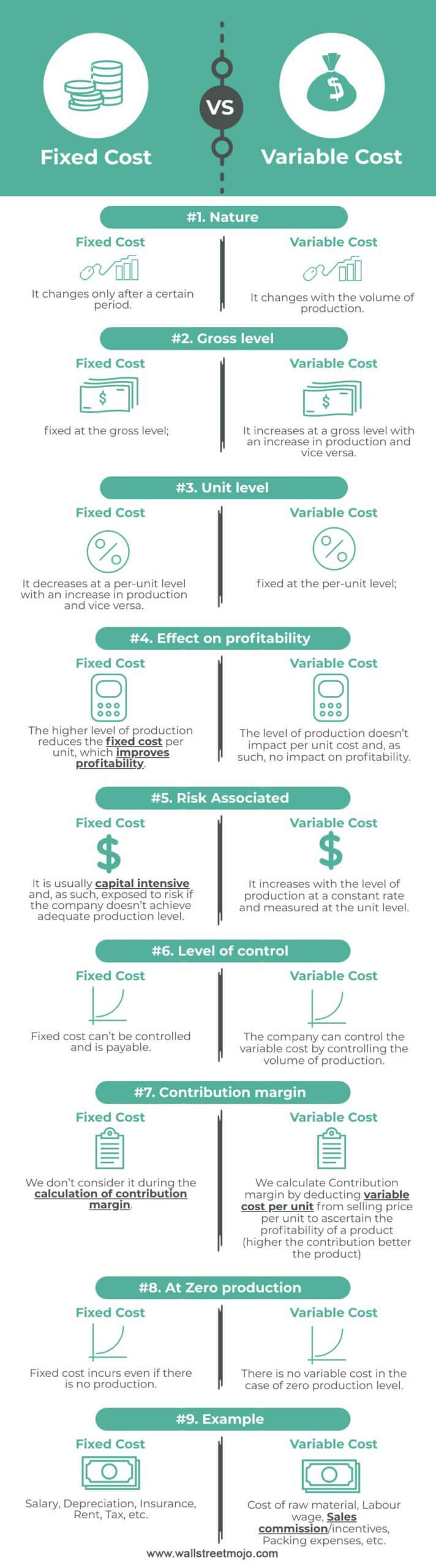

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

Explain the difference between absorption costing and variable costing.

. Does it change with the number of units. Variable costs are the ones who constantly keep on changing with the amount of material being produced or sold. The cost per unit will change as the number of units change.

Break-Even Analysis The knowledge of the fixed and variable expenses is essential for identifying a profitable price. A common example of a variable cost is the direct materials cost. Tap card to see definition.

Fixed cost is more or less constant over a period of time while variable cost. On the other hand variable costs include electricity and fuel charges wages to casual employees interest on working capital etc. 7 rows Fixed costs do not change with increasesdecreases in units of production volume while.

Variable costs change based on the amount of output produced. Tap again to see term. Variable cost remains the same irrespective of the number of units produced.

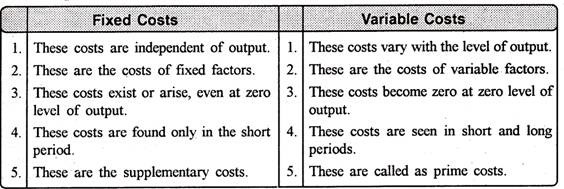

Fixed costs remain constant regardless of the level of output by the company. Total cost does not change with changes in the volume of activity within a relevant range. Fixed and variable costs also have a friend in common.

Variable costs may include labor commissions and raw materials. Under absorption costing fixed manufacturing costs are product costs. Variable costs are dependent on utilization levels and de-crease if utilization is reduced.

Fixed costs stay the same no matter how many sales you make while your total variable cost increases with sales volume. 6 Reasons Why Variable is Better in 2022 Variable is Historically and Statistically Shown to Cost Less than Fixed. Semi-variable costs which share qualities of each.

The cost that a business incurs even if the plant is idle and output is zero. Dependence on utilization. Click card to see definition.

In the next month you also get a 500. Semi-variable costs consist of both fixed and variable costs. Variable costs change in direct proportion to the changes in volume or business activity level.

The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes. It will not change unless if you are promoted or even demoted. Fixed costs are incurred irrespective of any units produced.

The best examples of a fixed cost can include costs such as rent electricity bill machinery and the buildings. As per the definition fixed cost is borne by the company throughout its functional period while variable cost changes based on the operations and productivity of a firm. These bills cannot easily be changed and are usually paid on a regular basis such as weekly monthly quarterly or from year to year.

The best examples of variable costs include payments made to the employees utilities and materials that are being used. Fixed cost decreases with an increase in the number of units produced. Therefore a cutback on fixed costs is much harder 1 Point.

These are costs which do change in direct proportion to the volume of sales. Under absorption costing fixed manufacturing costs are product costs. Fixed cost is the cost incurred by the producer on the purchase of fixed factor inputs used in short run production function.

Click card to see definition. For example suppose a. Click again to see term.

Even if the company doesnt have any business activity they still have to. Whereas variable cost is. In a month you earn a salary of 500.

These factors have no bearing on volume of production. Fixed costs however are independent and remain con-stant if employment is reduced. According to a 2001 report completed by Moshe Milevsky Professor of Finance at York University Schulich School of Business variable mortgage rates beat 5 year fixed rates 70 90 of the time.

Rent insurance administrative salaries are examples of fixed costs. Fixed cost remain fixed with every increasing level of output it dont vary with the change in output level. Total fixed costs are the sum of all consistent non-variable expenses a company must pay.

Fixed expenses cost the same amount each month. Examples include commission payments and overage charges. Which are closely related to the volume of production.

Taken together fixed and variable costs are the total cost of keeping your business running and making sales. The fixed costs include interest on fixed capital license fees wages to permanent staff etc. Variable Mortgage vs Fixed.

Commissions are a semi-variable labor costs. Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced. Variable costs can be easily managed and reduces the financial strain on the firm during times of low production levels compared to fixed costs that can be distressing for a firm that needs to maintain equipment factories and facilities even when optimum production levels are not reached.

They are usually percentages of sales that are paid to the employee who made the sale. Discuss net income effects. Fixed costs make up the two components of the goods or services total cost along with its inseparable partner component the variable cost.

Explain the difference between absorption costing and variable costing. Total costs are composed of both total fixed costs and total variable costs. Under variable costing fixed manufacturing costs are period costs.

1 Its much easier to budget for fixed expenses than it is to budget for a variable expense or discretionary expense. A company with zero. Fixed costs remain the same regardless of production output.

Under variable costing fixed manufacturing costs are period costs. Why Is It Important to Distinguish Between Fixed Costs and Variable Costs. These costs do not change just because you make or sell one more unit as long as.

Common examples of fixed costs include rentmortgagelease insurance taxes salaries legal fees advertising etc Variable costs. Variable costs are incurred as and when any units are produced.

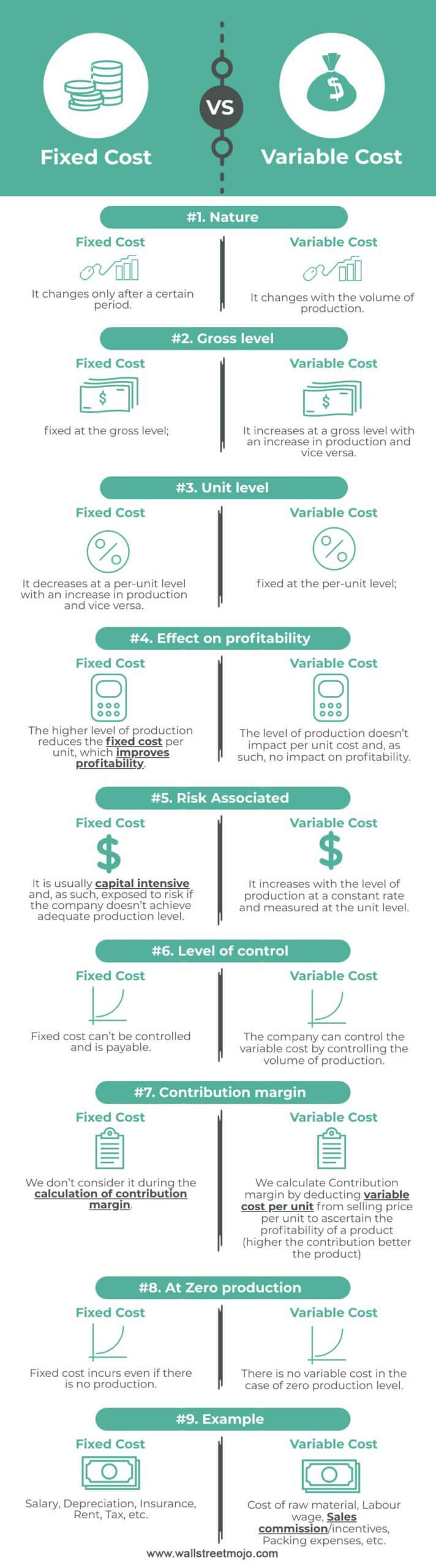

Difference Between Fixed Costs And Variable Costs

Difference Between Fixed Cost And Variable Cost With Example And Comparison Chart Key Differences

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

0 Comments